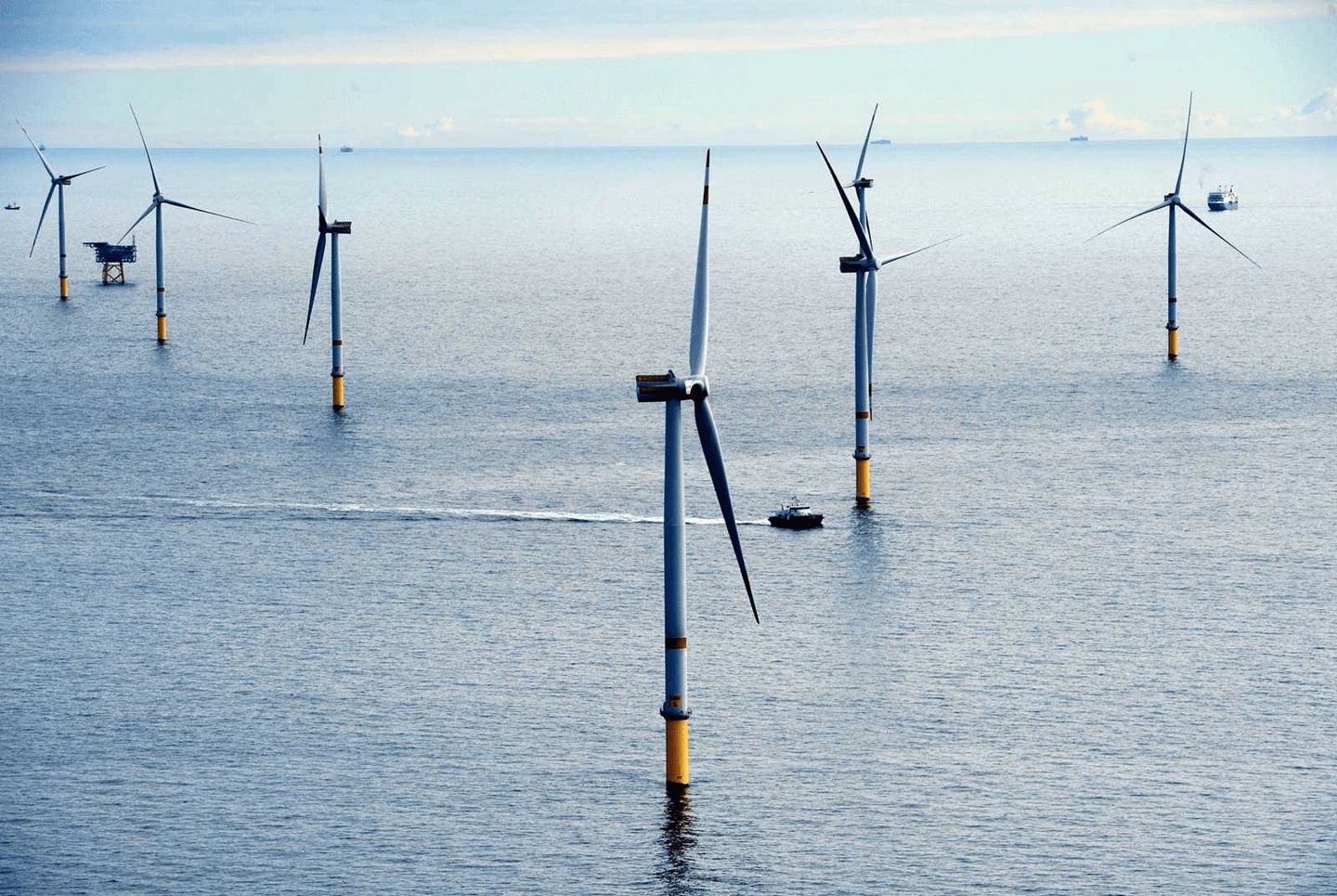

Financial close achieved for Taiwan’s Formosa 1 offshore wind farm

Formosa 1 is a joint venture between Ørsted (35% ownership), Taiwanese developer Swancor Renewable (15%), and Macquarie Capital (50%). The first phase of the project has been operational since April 2017 and consists of two 4MW offshore wind turbines.

For this project, long-term project financing will be utilized to fund the development, construction, commissioning, testing and operation of phase II and refinance the existing phase I facilities of the Formosa 1 project. The offshore wind farm is situated 2 to 6 kilometres from the Miaoli coast in North-Western Taiwan. Phase II, to be constructed in 2019, will add an extra 120MW of capacity through 20 6MW offshore wind turbines for a total capacity of 128MW.

The financial consortium comprises four local Taiwanese banks: Cathay United Bank, Taipei Fubon Commercial Bank, EnTie Commercial Bank, and KGI Bank. Furthermore, seven international banks have participated: ANZ Banking Group, BNP Paribas, Crédit Agricole Corporate and Investment Bank, DBS Bank, ING Bank, MUFJ Bank and Société Générale. It is also the first participation of EKF in a project financing in Taiwan.

The project financing for Formosa 1 has also enabled the local financial community to prepare for future investments in large-scale offshore wind projects in Taiwan. Matthias Bausenwein, Ørsted’s General Manager for Asia Pacific, said “We are glad to see that this important project milestone has been achieved now. Ørsted’s strong track record and professional experience have contributed to the project financing success and we will continue with solid support throughout the construction of Formosa 1’s second phase."

As a global leader in the offshore wind industry, Ørsted has shared its vast experience in financing offshore wind with its partners and local financial communities during the project financing process. Ørsted has supported or led the development of many aspects of Formosa 1 Phase II such as project financing, technical design, procurement, health and safety, project quality management plans, construction, and operations and maintenance planning.

For further information, please contact:

Ørsted Asia-Pacific Media Relations

Rachel Chan

racch@orsted.com

+886 933 529 367